Page 15 - GXO New Hire Guide

P. 15

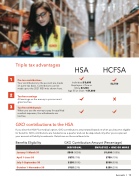

Triple tax advantages

1

2 3

HSA HCFSA

Pre-tax contributions

Your contributions to the account are made on a pre-tax basis. Contributions can be made up to the 2021 IRS limits shown here.

Individual:$3,600 Employee + One or More:$7,200

Age 55 or Over: + $1,000

$2,750

Tax-free earnings

All earnings on the money in your account grow tax-free.

Tax-free withdrawals

When you use the money to pay for qualified medical expenses, the withdrawals are tax-free.

GXO contributions to the HSA

If you elect the HSA Plus medical option, GXO contributions are prorated based on when you become eligible for benefits. GXO contributions are funded once a quarter and can be deposited only after you’ve opened your account at Fidelity Investments. Details are on the enrollment site.

Benefits Eligibility GXO Contribution Amount (Percentage)

October 1–November 30 $125 (25%) $250 (25%)

Accounts I 13

INDIVIDUAL

EMPLOYEE + ONE OR MORE

January 1–March 31

$500 (100%)

$1,000 (100%)

April 1–June 30

$375 (75%)

$750 (75%)

July 1–September 30

$250 (50%)

$500 (50%)